I suppose I can hardly escape making some comment about yesterday's budget, but the comment is a simple one: that we got what we expected.

I can't believe that anyone, other than those who were persuaded to vote Tory because of it, believed the Tories when they said they had no intention of raising VAT. People who would have voted Tory anyway knew they would, as did those that would never vote Tory. But VAT isn't the big issue.

Nobody doubts that we are in a financial hole. The Tory and LibDem mantra is that it is a hole of Labour's making, but that's just a soundbite. I think it's a hole that Labour could have done more to help us avoid—by less reckless spending and by better management of the economy and regulation of the banks—but the main reason for the mess is that the Western World had a banking crisis which involved governments having to bail out the banks to stop them collapsing, and then pump cheap money into them to persuade them to start trading again, most of which they pocketed. Nobody can blame Labour for all of that ... not least because the other parties would have done pretty much the same.

No, the bigger picture is that we are in a hole and that we have to pay to get out of it. The choice is how we get out of it. The Tories went into the election on the platform of doing it by drastically cutting public services (whatever euphemisms they use to disguise it) rather than raising taxes. That is what they duly delivered in yesterday's budget: the ratio is about 80% cuts in services to 20% increases in taxes. In my opinion that is precisely the wrong way round. Yes, there are cuts that can be made, but we should have looked to increase taxes as the main way out.

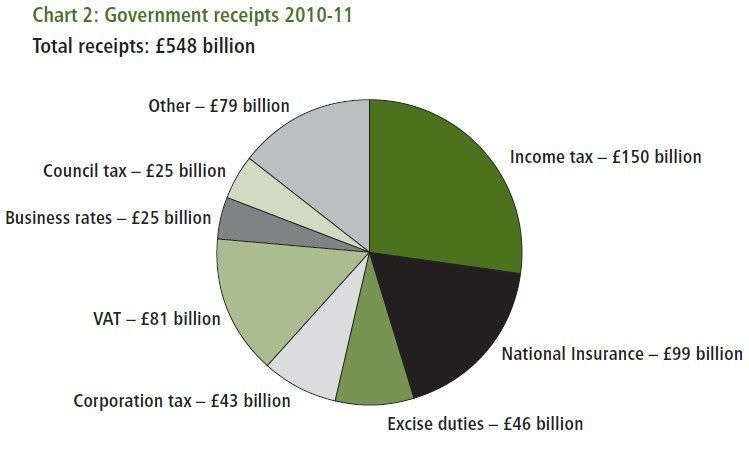

Which taxes? For me, the answer should be to increase direct taxes, because these are directly linked to the ability to pay. That means income tax and employees' national insurance. It means that those who are still in work pay, but those that are thrown out of work by the recession (whether first or second dip) do not. The diagram below, from the Budget Statement (download it from here) shows just how large a proportion of government income comes from these two sources.

So a modest increase in income tax (employees' NI is in effect income tax by another name, but it does not cover those whose income is unearned, which is why it is better to increase income tax) would be the most effective way to pay for getting us out of the mess. Income tax is now ludicrously low. When the Tories last came to power in 1979 the basic rate was 33% ... since then it has been reduced all the way down to 20%. But it seems that no government, either Labour or Tory, will contemplate increasing it again. Gordon Brown even took away the 10p starter rate simply in order to reduce the basic rate by 2p, announcing it as if he had pulled a rabbit out of a hat and expecting praise for it. When he realized that he had made the poor poorer, he corrected it by giving not only the working poor, but everyone else who paid income tax as well, a further tax break ... which was paid for out of borrowing. Borrowing money to give people tax breaks is obscene.

It should be pretty obvious that because the level of borrowing is such a problem, the only sane thing to do is put the basic rate up again. But of course the Tories won't do that on principle, and the LibDems wanted to go even further and give every basic rate taxpayer a bonus by increasing the threshold to £10,000. At least the LibDems proposal would have benefited more people on low wages by taking them out of tax, but to my mind that would only be fair if the basic rate of tax went up so that the net take was not reduced.

I can only conclude that increasing the basic rate of income tax has been taken off the political agenda by a right-wing press (and a few pressure groups) who have managed to convince the electorate that everything can be paid for if we attack "waste" and "bureaucracy" and "benefits scroungers" instead. It worked. Neither Labour nor the LibDems dared propose it because it would be a vote loser. We have ended up with what middle England voted for.

-

So is that unfair to Wales? Make up your own minds. In the end it boils down to what sort of society we want to live in. We can have a low tax, low public services society or a society in which we pay for the public services we value.

But first we must value our public services. I'm certainly not saying that we should pay for all the things we pay for now, but I am saying we should decide what public services we want, and be prepared to pay for them and hold those we elect directly accountable for them. Public services should be public, rather than farmed out to the private sector or to quangos or "arms length" bodies.

To caricature, I would much rather we had what people usually think of as a Scandinavian model in which we pay higher taxes for the things which we as a society value as public services, than the more Anglo-Saxon model of as little as possible being public and as much as possible being private because private is somehow intrinsically better.

How do we get there? For me and every Plaid Cymru supporter the answer is obvious. But for a large number of those who regard themselves as Welsh Labour and who are troubled by what the Labour Party had to do to make itself electable in England (and will have to do again to have any hope of getting elected next time) the answer will require rather more soul searching. For if you believe that Wales does, or at least should, have different and better values ... if you fear that those values will be trampled down by what this budget will inevitably produce ... then start now to press for more fiscal responsibility for Wales. We need to be in control of the levers of our economy, to decide for ourselves how we tax ourselves to pay for what we believe we need, and how we become prosperous enough to pay for it.

This budget was never primarily about reducing the deficit ... it was about reducing public services. It about reducing the size of the state. I agree with that, because most of our public services are better provided at a more local level, and are that much more accountable because of it. So yes, I'm completely in favour of reducing the size of the state ...

... from 60 million to 3 million people.

3 comments:

We need public services - but not necessarily the ones we have! We don't need trident - why do our police forces need BMW cars? Why does every reorganisatoon result in more directors and less doers? And do we really need social services?

Do we need the monarchy? £180 million PA directly out of public funds. Much Much more when you look at things like the cost, paid by local communities, to police royal visits etc.

Ireland pays $2 Million pa for its president, and I have to say that personally I think Mary McAleese is a far more compelling representative for her country than our Brenda is for us.

You are right NH - Income tax should go up. I agree with the £10k threshold, but after that there should be a much steeper incremental scale. And if that means bankers moving to Switzerland - let them! They'll be paying even more tax there! But no one will do it. I will write today to my new MP, geraint davies, and urge him to use his best efforts to achieve more fiscal autonomy for Wales!

Have you noticed that Labour in Wales - Carwyn and Jane Hutt in particular, are sounding just like Plaid pre-election? Complaining about the bad deal etc. Why didn't they do anything during the last 10 years, then?

golden goose outlet

michael kors outlet

reebok shoes

michael kors

supreme hoodie

kyrie 4

adidas outlet online

jordan 6

canada goose UK

yeezy boost 350 v2

Post a Comment